Uncategorized

Best Indian CPA (Certified Public Accountant) in Aurora, IL

Uncategorized

Top 10 Questions You May Ask this Tax Season

Please start gathering the following forms, documents, and information. These are generic and depending on your tax situation, you may need additional tax forms, documents, and information.

- Tax Form W-2 received from your employer for your salaries

- Last pay-stub received for the year

- Tax Form 1099-INT received from your bank and financial institutions for interest received.

- Tax Form 1099-DIV received from your brokers and financial institutions for dividend received.

- Tax Form 1099-B received from your brokers and financial institutions for capital gains or losses on sale of your shares / stocks.

- Tax Form 1099-NEC received from your customers / clients for nonemployee compensation received for working as a contractor/subcontractor .

- Tax Form 1099-Misc received from your payors of rent, and various other income.

- Tax Form 1099-R received for distributions from your retirement accounts.

- Tax Form 1099-SSA received for Social Security benefits.

- Tax Form 1099-SSA received for Social Security benefits.

- Tax Form 1098-T received from School / Educational institutions.

- Tax Form 1098-E received for interest paid on Student Loan.

- Tax Form 1098 received for interest paid on mortgage.

- Property taxes paid and date of payment.

- Charitable contributions made in cash and also in kind.

The tax years that a taxpayer can use are:

Calendar year – 12 consecutive months beginning January 1 and ending December 31.

Fiscal year – 12 consecutive months ending on the last day of any month except December (* See Note below for 52-53 week tax year).

Note : A 52-53-week tax year is a fiscal tax year that varies from 52 to 53 weeks but does not have to end on the last day of a month.

Unless you have a required tax year, you adopt a tax year by filing your first income tax return using that tax year. A required tax year is a tax year required under the Internal Revenue Code and the Income Tax Regulations. You have not adopted a tax year if you merely did any of the following.

- Filed an application for an extension of time to file an income tax return.

- Filed an application for an employer identification number.

- Paid estimated taxes for that tax year.

If you file your first tax return using the calendar tax year and you later begin business as a sole proprietor, become a partner in a partnership, or become a shareholder in an S corporation, you must continue to use the calendar year unless you get IRS approval to change it or meet one of the exceptions.

Generally, anyone can adopt the calendar year. However, if any of the following apply, you must adopt the calendar year.

- You keep no books or records;

- You have no annual accounting period;

- Your present tax year does not qualify as a fiscal year; or

- You are required to use a calendar year by a provision of the Internal Revenue Code or the Income Tax Regulations.

Individual Tax Returns are due by April 15th and if that falls on Saturday, or Sunday, or a decarded public holiday, then on the next business day.

File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia – even if you don’t live in the District of Columbia. If you live in Maine or Massachusetts, you have until April 19, 2022. That is because of the Patriots’ Day holiday in those states.

C Corporation Tax Returns are due by April 15 and if that falls on Saturday, or Sunday, or a decarded public holiday, then on the next business day.

LLC tax returns are due based on how they are filed:

If Single Member LLC chooses to file Schedule C then April 15.

Multi-member LLC can file as Partnership by March 15.

LLC that elects S Corp status have to file tax returns by March 15.

LLC that elects C Corp status have to file tax returns by April 15.

If the due date falls on Saturday, or Sunday, or a decarded public holiday, then the returns are due on the next business day.

Most state(s) follow the federal due date. We recommend to please look at the state taxes page to find the due date for your state.

Disclaimer: This website should not be treated as primary source of information and may contain incorrect, outdated information, or typographical error. Please always double check the information.

- Standard deduction or itemized deductions : Almost everyone is eligible for standard deduction or itemized deductions. These are often the most significant deductions to reduce your taxable income.

- Student loan interest

- Work-Related Education Expenses

- Educator Expense Deduction

- Archer MSA Deduction

- Jury duty pay

- Deductible expenses related to income reported on line 8k from the rental of personal property engaged in for profit.

- Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8l.

- Repayment of supplemental unemployment benefits

- Contributions to section 501(c)(18) (D) pension plans

- Contributions by certain chaplains to section 403(b) plans

- Attorney fees and court costs for actions involving certain unlawful discrimination claims,

- Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations

- Housing deduction from Form 2555

- Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041),

- any adjustments not reported elsewhere

Use Schedule 8812 (Form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. For taxpayers meeting certain residency requirements, these credits are a refundable child tax credit (RCTC) and a nonrefundable credit for other dependents (ODC). For other taxpayers, these credits are a nonrefundable child tax credit (NCTC), the ODC, and a refundable additional child tax credit (ACTC).

For 2021, the child tax credit applies to qualifying children who have not attained age 18 by the end of 2021. Also, the initial amount of the child tax credit is increased to $3,600 for each qualifying child who has not attained age 6 by the end of 2021 and $3,000 for each other qualifying child who has not attained age 18 by the end of 2021. The credit for other dependents has not been enhanced.

Letter 6419.

If you received advance child tax credit payments during 2021, you will receive Letter 6419. Keep this letter with your tax records. You will use the information in this letter to figure your child tax credit on your 2021 tax return or the amount of additional tax you must report on Schedule 2 (Form 1040).

Additional tax on excess advance child tax credit payments.

If you received advance child tax credit payments during 2021 and the credits you figure using Schedule 8812 are less than what you received, you may owe an additional tax. Complete Schedule 8812 to determine if you must report an additional tax on Schedule 2 (Form 1040).

For 2021, the American Rescue Plan Act of 2021 (the ARP) increases the amount of the credit for child and dependent care expenses. It also makes the credit refundable for taxpayers that meet certain residency requirements, increases the percentage of employment-related expenses for qualifying care considered in calculating the credit, and modifies the phaseout of the credit for higher earners. For 2021, you may claim the credit on qualifying employment-related expenses of up to $8,000 (previously $3,000) if you had one qualifying person, or $16,000 (previously $6,000) if you had two or more qualifying persons. The maximum credit in 2021 increases to 50% of your employment-related expenses, which equals a maximum credit of $4,000 if you had one qualifying person (50% of $8,000), or $8,000 (50% of $16,000) if you had two or more qualifying persons. The more a taxpayer earns, the lower the percentage of employment-related expenses that are considered in determining the credit. Under the ARP, the adjusted gross income level at which the credit percentage starts to phase out is raised to $125,000 for 2021. Above $125,000, the 50% credit percentage goes down as income rises. For 2021, the credit figured on Form 2441, Child and Dependent Care Expenses, line 9a, is unavailable for any taxpayer with adjusted gross income over $438,000; however, you may still be eligible to claim a credit on Form 2441, line 9b, for 2020 expenses paid in 2021. See the line 8 instructions in the Instructions for Form 2441 for the 2021 Phaseout Schedule. The refundable credit is reported on Form 2441, line 10. The nonrefundable credit is reported on Form 2441, line 11.

The deduction for personal exemptions has been suspended from tax years 2018 through 2025.

Any economic impact payment you received is not taxable for federal income tax purposes, but will reduce your recovery rebate credit.

Standard deduction amount has increased for 2021.

The amounts are:

• Single or Married filing separately—$12,550.

• Married filing jointly or Qualifying widow(er)—$25,100.

• Head of household—$18,800

If, in 2021, you engaged in a transaction involving virtual currency, you will need to answer “Yes” to the question on page 1 of Form 1040 or 1040-SR.

Do not leave this field blank. The question must be answered by all taxpayers, not just taxpayers who engaged in a transaction involving virtual currency.

Disclaimer: This website should not be treated as primary source of information and may contain incorrect, outdated information, or typographical error. Please do not rely on our website always double check the information and do our own research or contact us for more information.

How can Prem Tax and Accounting help?

Congratulations! Your hard work is finally paying you.

We can help you keep your hard earned dollars by helping you plan your taxes customized to your tax situation, and employ creative tax strategies to take control of your taxes.

We are different from other CPAs. Most CPAs are focused on just completing the checklist and filling out the form, while we at Prem Tax and Accounting, take time and make all attempts to first understand your situation, and then come up with plans which is customized just for you. We attempt to come up with creative tax strategies to lower your taxes, maximize deductions, look for all the credits available for your benefits not only in current year but later years also.

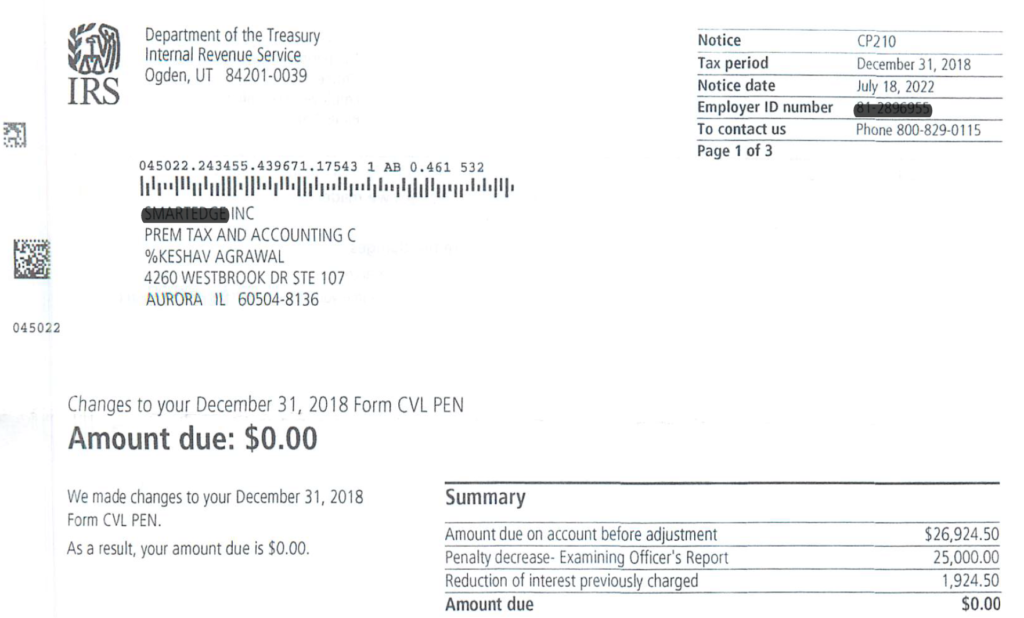

SAMPLE of our handling of IRS Issues

Businesses:

- C Corp

- S Corp

- Partnerships

- LLCs filing as Sch C

- LLCs filing as S Corp

- LLCs filing as C Corp

- Multi-National

- Transfer Pricing

Individuals

- Great success rate

- Huge experience

- See samples of outcome of our IRS handling

Choice of State:

Choice of entity

- C Corp

- S Corp

- LLC

- Single or Multi-states

- County and City level compliance also

- Compliance with Labor laws

- Direct deposit included

- Employee portal

- Retirement plans

- Low cost

- All state(s)

- Apply correct rates

- Claim all exemptions available

- Low cost

Our Locations

MFJ vs MFS, Tax Planning

Marriage Penalty

What Is a Marriage Penalty?

A marriage penalty is when a household’s overall tax bill is higher if the married couple file taxes jointly.

A marriage penalty typically occurs when both spouses have similar incomes. This is true for both high- and low-income couples.

Federal Marriage Penalty

| Tax Rate | For Single Filers | For Married Individuals Filing Joint Returns | For Heads of Households |

|---|---|---|---|

| 10% | $0 to $11,000 | $0 to $22,000 | $0 to $15,700 |

| 12% | $11,000 to $44,725 | $22,000 to $89,450 | $15,700 to $59,850 |

| 22% | $44,725 to $95,375 | $89,450 to $190,750 | $59,850 to $95,350 |

| 24% | $95,375 to $182,100 | $190,750 to $364,200 | $95,350 to $182,100 |

| 32% | $182,100 to $231,250 | $364,200 to $462,500 | $182,100 to $231,250 |

| 35% | $231,250 to $578,125 | $462,500 to $693,750 | $231,250 to $578,100 |

| 37% | $578,125 or more | $693,750 or more | $578,100 or more |

State Marriage Penalty

Seven additional states (Arkansas, Delaware, Iowa, Mississippi, Missouri, Montana, and West Virginia), as well as the District of Columbia, offset the marriage penalty in their bracket structure by allowing married taxpayers to file separately on the same return to avoid losing credits and exemptions available to joint filers or which cannot be allocated among filers (for instance, child tax credits).

Ten states have a graduated-rate income tax but double their brackets to avoid a marriage penalty: Alabama, Arizona, Connecticut, Hawaii, Idaho, Kansas, Louisiana, Maine, Nebraska, and Oregon.

ERC, Pandemic, Payroll, Tax Credit

Employee Retention Credit (ERC)- 2020 vs 2021 Comparison Chart

The federal government established the Employee Retention Credit (ERC) to provide a refundable employment tax credit to help businesses with the cost of keeping staff employed.

Eligible businesses that experienced a decline in gross receipts or were closed due to government order and didn’t claim the credit when they filed their original return can take advantage by filing adjusted employment tax returns. For example, businesses that file quarterly employment tax returns can file Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for RefundPDF, to claim the credit for prior 2020 and 2021 quarters.

With the exception of a recovery startup business, most taxpayers became ineligible to claim the ERC for wages paid after September 30, 2021. A recovery startup business can still claim the ERC for wages paid after June 30, 2021, and before January 1, 2022. Eligible employers may still claim the ERC for prior quarters by filing an applicable adjusted employment tax return within the deadline set forth in the corresponding form instructions. For example, if an employer files a Form 941, the employer still has time to file an adjusted return within the time set forth under the “Is There a Deadline for Filing Form 941-X?” section in Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

Reminder: If you filed Form 941-X to claim the Employee Retention Credit, you must reduce your deduction for wages by the amount of the credit, and you may need to amend your income tax return (e.g., Forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. For additional information, please refer to the following resources:

- Notice 2021-20, Guidance on the Employee Retention Credit under Section 2301 of the Coronavirus Aid, Relief, and Economic Security Act, question 60PDF.

- Notice 2021-49, Guidance on the Employee Retention Credit under Section 3134 of the Code and Miscellaneous Issues Related to the Employee Retention Credit, Section IV.CPDF.

For more information, see Correcting Employment Taxes.

The ERC has been amended three separate times after it was originally enacted as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) in March of 2020 by the Taxpayer Certainty and Disaster Relief Act of 2020 (Relief Act), the American Rescue Plan (ARPA) Act of 2021, and the Infrastructure Investment and Jobs Act (IIJA).

| CARES Act of March 2020 | Relief Act of 2021 | American Rescue Plan Act of 2021 | Infrastructure Investment and Jobs Act (IIJA) | |

|---|---|---|---|---|

| Period for qualified wages paid | March 13 – December 31, 2020 | Extended: January 1 – June 30, 2021 | Extended: July 1, 2021 – December 31, 2021* *IIJA retroactively amends section 3134 to limit availability in the fourth quarter of 2021 to a recovery startup business. | October 1 – December 31, 2021 for wages paid only by a recovery start up business, as defined in section 3134(c)(5) of the Code. |

| Eligible employer | Any employer operating a trade, business, or a tax-exempt organization, but not governments, their agencies, and instrumentalities. | For calendar quarters in 2021, expanded to include certain governmental employers that are:

| No changes | No change |

| Employment tax offset | Employer’s portion of Social Security tax | No change | Changed to employer’s portion of Medicare tax | No change |

| Eligibility requirements | Employer must experience:

| For calendar quarters in 2021, amended decline in gross receipts to be defined as quarter where gross receipts are less than 80% of the same quarter in 2019. For calendar quarters in 2021, added an alternative quarter election rule giving employers ability to look at prior calendar quarter and compare to the same calendar quarter in 2019 to determine whether there was a decline in gross receipts. Provided a rule for employers not existence in 2019 to allow employers that were not in existence in 2019 to determine whether there was a decline in gross receipts by comparing the calendar quarter in 2021 to its gross receipts to the same calendar quarter in 2020. | For third and fourth calendar quarters of 2021, amended to make the credit available to “recovery startup businesses,” employers who otherwise do not meet eligibility criteria (full or partial suspension or decline in gross receipts) “Recovery startup businesses” are employers:

| Limited availability for the fourth quarter of 2021 to a recovery startup business as defined in section 3134(c)(5) of the Code. Removed requirement for fourth calendar quarter that a recovery startup business not otherwise be an eligible employer due to a full or partial suspension of operations or a decline in gross receipts. |

| Percent of qualified wages eligible for credit |

|

|

|

|

| Credit maximums | Maximum credit of $5,000 per employee in 2020 | Increased the maximum per employee to $7,000 per employee per quarter in 2021 |

|

|

ERC, Pandemic, Payroll, Tax Credit, Uncategorized

Employers warned to beware of third parties promoting improper Employee Retention Credit (ERC) claims

WASHINGTON — The Internal Revenue Service today warned employers to be wary of third parties who are advising them to claim the Employee Retention Credit (ERC) when they may not qualify. Some third parties are taking improper positions related to taxpayer eligibility for and computation of the credit.

These third parties often charge large upfront fees or a fee that is contingent on the amount of the refund and may not inform taxpayers that wage deductions claimed on the business’ federal income tax return must be reduced by the amount of the credit.

If the business filed an income tax return deducting qualified wages before it filed an employment tax return claiming the credit, the business should file an amended income tax return to correct any overstated wage deduction.

Businesses are encouraged to be cautious of advertised schemes and direct solicitations promising tax savings that are too good to be true. Taxpayers are always responsible for the information reported on their tax returns. Improperly claiming the ERC could result in taxpayers being required to repay the credit along with penalties and interest.

What is the ERC?

The ERC is a refundable tax credit designed for businesses who continued paying employees while shutdown due to the COVID-19 pandemic or had significant declines in gross receipts from March 13, 2020 to December 31, 2021. Eligible taxpayers can claim the ERC on an original or amended employment tax return for a period within those dates.

To be eligible for the ERC, employers must have:

- sustained a full or partial suspension of operations due to orders from an appropriate governmental authorityPDF limiting commerce, travel, or group meetings due to COVID-19 during 2020 or the first three quarters of 2021,

- experienced a significant decline in gross receipts during 2020PDF or a decline in gross receipts during the first three quarters of 2021PDF, or

- qualified as a recovery startup businessPDF for the third or fourth quarters of 2021.

As a reminder, only recovery startup businesses are eligible for the ERC in the fourth quarter of 2021. Additionally, for any quarter, eligible employers cannot claim the ERC on wages that were reported as payroll costs in obtaining PPP loan forgiveness or that were used to claim certain other tax credits.

To report tax-related illegal activities relating to ERC claims, submit Form 3949-A, Information ReferralPDF. You should also report instances of fraud and IRS-related phishing attempts to the Treasury Inspector General for Tax Administration at 800-366-4484.

Go to IRS.gov to learn more about eligibility requirements and how to claim the Employee Retention Credit :

- For qualified wages paid after March 12, 2020, and before January 1, 2021 – Notice 2021-20, Notice 2021-49, and Revenue Procedure 2021-33

- For qualified wages paid after December 31, 2020, and before July 1, 2021 – Notice 2021-23, Notice 2021-49 and Revenue Procedure 2021-33

- For qualified wages paid after June 30, 2021, and before October 1, 2021 – Notice 2021-49 and Revenue Procedure 2021-33

- For qualified wages paid after September 30, 2021, and before January 1, 2022 – Notice 2021-49 and Notice 2021-65