How can Prem Tax and Accounting help?

Congratulations! Your hard work is finally paying you.

We can help you keep your hard earned dollars by helping you plan your taxes customized to your tax situation, and employ creative tax strategies to take control of your taxes.

We are different from other CPAs. Most CPAs are focused on just completing the checklist and filling out the form, while we at Prem Tax and Accounting, take time and make all attempts to first understand your situation, and then come up with plans which is customized just for you. We attempt to come up with creative tax strategies to lower your taxes, maximize deductions, look for all the credits available for your benefits not only in current year but later years also.

You are required to pay taxes only if you have taxable income. You compute taxable income after deducting all the tax write offs. See below.

There are many questions, that you need to consider before you choose the right entity structure for you. There may be <br>

- Liability protection

- Management flexibility

- Self employment taxes or Payroll taxes

- Nationality and Residential Status

- Single or double tax

- Tax bracket management

- Control of business

- Risk Management

- more…

We will help you understand it offer pros and cons and what is best for you given your tax situation.

Tax write offs available to content creators and influencers:

- Computer Hardware

- Computer Software

- Cell Phones and accessories

- Cell phone plans

- Internet

- App and subscription fees

- Supplies

- Admin support

- Creative support

- Consulting

- Legal and professional fees

- Car and auto expenses

- Advertising

- Sales promotion

- Prizes

- educational exp

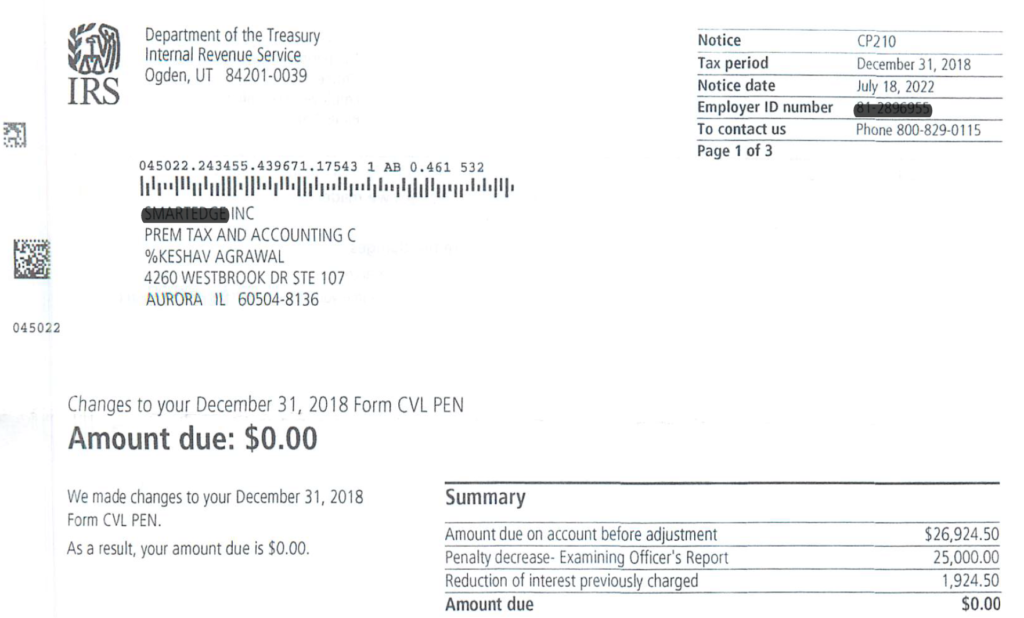

SAMPLE of our handling of IRS Issues

Businesses:

- C Corp

- S Corp

- Partnerships

- LLCs filing as Sch C

- LLCs filing as S Corp

- LLCs filing as C Corp

- Multi-National

- Transfer Pricing

Individuals

- Great success rate

- Huge experience

- See samples of outcome of our IRS handling

Choice of State:

Choice of entity

- C Corp

- S Corp

- LLC

- Single or Multi-states

- County and City level compliance also

- Compliance with Labor laws

- Direct deposit included

- Employee portal

- Retirement plans

- Low cost

- All state(s)

- Apply correct rates

- Claim all exemptions available

- Low cost