Category: Uncategorized

Uncategorized

Top 10 Questions You May Ask this Tax Season

Answer to top 10 tax questions answered by an experienced CPA, tax preparer, and tax expert offer free initial consulting.

Please start gathering the following forms, documents, and information. These are generic and depending on your tax situation, you may need additional tax forms, documents, and information.

- Tax Form W-2 received from your employer for your salaries

- Last pay-stub received for the year

- Tax Form 1099-INT received from your bank and financial institutions for interest received.

- Tax Form 1099-DIV received from your brokers and financial institutions for dividend received.

- Tax Form 1099-B received from your brokers and financial institutions for capital gains or losses on sale of your shares / stocks.

- Tax Form 1099-NEC received from your customers / clients for nonemployee compensation received for working as a contractor/subcontractor .

- Tax Form 1099-Misc received from your payors of rent, and various other income.

- Tax Form 1099-R received for distributions from your retirement accounts.

- Tax Form 1099-SSA received for Social Security benefits.

- Tax Form 1099-SSA received for Social Security benefits.

- Tax Form 1098-T received from School / Educational institutions.

- Tax Form 1098-E received for interest paid on Student Loan.

- Tax Form 1098 received for interest paid on mortgage.

- Property taxes paid and date of payment.

- Charitable contributions made in cash and also in kind.

The tax years that a taxpayer can use are:

Calendar year – 12 consecutive months beginning January 1 and ending December 31.

Fiscal year – 12 consecutive months ending on the last day of any month except December (* See Note below for 52-53 week tax year).

Note : A 52-53-week tax year is a fiscal tax year that varies from 52 to 53 weeks but does not have to end on the last day of a month.

Unless you have a required tax year, you adopt a tax year by filing your first income tax return using that tax year. A required tax year is a tax year required under the Internal Revenue Code and the Income Tax Regulations. You have not adopted a tax year if you merely did any of the following.

- Filed an application for an extension of time to file an income tax return.

- Filed an application for an employer identification number.

- Paid estimated taxes for that tax year.

If you file your first tax return using the calendar tax year and you later begin business as a sole proprietor, become a partner in a partnership, or become a shareholder in an S corporation, you must continue to use the calendar year unless you get IRS approval to change it or meet one of the exceptions.

Generally, anyone can adopt the calendar year. However, if any of the following apply, you must adopt the calendar year.

- You keep no books or records;

- You have no annual accounting period;

- Your present tax year does not qualify as a fiscal year; or

- You are required to use a calendar year by a provision of the Internal Revenue Code or the Income Tax Regulations.

Individual Tax Returns are due by April 15th and if that falls on Saturday, or Sunday, or a decarded public holiday, then on the next business day.

File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia – even if you don’t live in the District of Columbia. If you live in Maine or Massachusetts, you have until April 19, 2022. That is because of the Patriots’ Day holiday in those states.

C Corporation Tax Returns are due by April 15 and if that falls on Saturday, or Sunday, or a decarded public holiday, then on the next business day.

LLC tax returns are due based on how they are filed:

If Single Member LLC chooses to file Schedule C then April 15.

Multi-member LLC can file as Partnership by March 15.

LLC that elects S Corp status have to file tax returns by March 15.

LLC that elects C Corp status have to file tax returns by April 15.

If the due date falls on Saturday, or Sunday, or a decarded public holiday, then the returns are due on the next business day.

Most state(s) follow the federal due date. We recommend to please look at the state taxes page to find the due date for your state.

Disclaimer: This website should not be treated as primary source of information and may contain incorrect, outdated information, or typographical error. Please always double check the information.

- Standard deduction or itemized deductions : Almost everyone is eligible for standard deduction or itemized deductions. These are often the most significant deductions to reduce your taxable income.

- Student loan interest

- Work-Related Education Expenses

- Educator Expense Deduction

- Archer MSA Deduction

- Jury duty pay

- Deductible expenses related to income reported on line 8k from the rental of personal property engaged in for profit.

- Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8l.

- Repayment of supplemental unemployment benefits

- Contributions to section 501(c)(18) (D) pension plans

- Contributions by certain chaplains to section 403(b) plans

- Attorney fees and court costs for actions involving certain unlawful discrimination claims,

- Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations

- Housing deduction from Form 2555

- Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041),

- any adjustments not reported elsewhere

Use Schedule 8812 (Form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. For taxpayers meeting certain residency requirements, these credits are a refundable child tax credit (RCTC) and a nonrefundable credit for other dependents (ODC). For other taxpayers, these credits are a nonrefundable child tax credit (NCTC), the ODC, and a refundable additional child tax credit (ACTC).

For 2021, the child tax credit applies to qualifying children who have not attained age 18 by the end of 2021. Also, the initial amount of the child tax credit is increased to $3,600 for each qualifying child who has not attained age 6 by the end of 2021 and $3,000 for each other qualifying child who has not attained age 18 by the end of 2021. The credit for other dependents has not been enhanced.

Letter 6419.

If you received advance child tax credit payments during 2021, you will receive Letter 6419. Keep this letter with your tax records. You will use the information in this letter to figure your child tax credit on your 2021 tax return or the amount of additional tax you must report on Schedule 2 (Form 1040).

Additional tax on excess advance child tax credit payments.

If you received advance child tax credit payments during 2021 and the credits you figure using Schedule 8812 are less than what you received, you may owe an additional tax. Complete Schedule 8812 to determine if you must report an additional tax on Schedule 2 (Form 1040).

For 2021, the American Rescue Plan Act of 2021 (the ARP) increases the amount of the credit for child and dependent care expenses. It also makes the credit refundable for taxpayers that meet certain residency requirements, increases the percentage of employment-related expenses for qualifying care considered in calculating the credit, and modifies the phaseout of the credit for higher earners. For 2021, you may claim the credit on qualifying employment-related expenses of up to $8,000 (previously $3,000) if you had one qualifying person, or $16,000 (previously $6,000) if you had two or more qualifying persons. The maximum credit in 2021 increases to 50% of your employment-related expenses, which equals a maximum credit of $4,000 if you had one qualifying person (50% of $8,000), or $8,000 (50% of $16,000) if you had two or more qualifying persons. The more a taxpayer earns, the lower the percentage of employment-related expenses that are considered in determining the credit. Under the ARP, the adjusted gross income level at which the credit percentage starts to phase out is raised to $125,000 for 2021. Above $125,000, the 50% credit percentage goes down as income rises. For 2021, the credit figured on Form 2441, Child and Dependent Care Expenses, line 9a, is unavailable for any taxpayer with adjusted gross income over $438,000; however, you may still be eligible to claim a credit on Form 2441, line 9b, for 2020 expenses paid in 2021. See the line 8 instructions in the Instructions for Form 2441 for the 2021 Phaseout Schedule. The refundable credit is reported on Form 2441, line 10. The nonrefundable credit is reported on Form 2441, line 11.

The deduction for personal exemptions has been suspended from tax years 2018 through 2025.

Any economic impact payment you received is not taxable for federal income tax purposes, but will reduce your recovery rebate credit.

Standard deduction amount has increased for 2021.

The amounts are:

• Single or Married filing separately—$12,550.

• Married filing jointly or Qualifying widow(er)—$25,100.

• Head of household—$18,800

If, in 2021, you engaged in a transaction involving virtual currency, you will need to answer “Yes” to the question on page 1 of Form 1040 or 1040-SR.

Do not leave this field blank. The question must be answered by all taxpayers, not just taxpayers who engaged in a transaction involving virtual currency.

Disclaimer: This website should not be treated as primary source of information and may contain incorrect, outdated information, or typographical error. Please do not rely on our website always double check the information and do our own research or contact us for more information.

How can Prem Tax and Accounting help?

Congratulations! Your hard work is finally paying you.

We can help you keep your hard earned dollars by helping you plan your taxes customized to your tax situation, and employ creative tax strategies to take control of your taxes.

We are different from other CPAs. Most CPAs are focused on just completing the checklist and filling out the form, while we at Prem Tax and Accounting, take time and make all attempts to first understand your situation, and then come up with plans which is customized just for you. We attempt to come up with creative tax strategies to lower your taxes, maximize deductions, look for all the credits available for your benefits not only in current year but later years also.

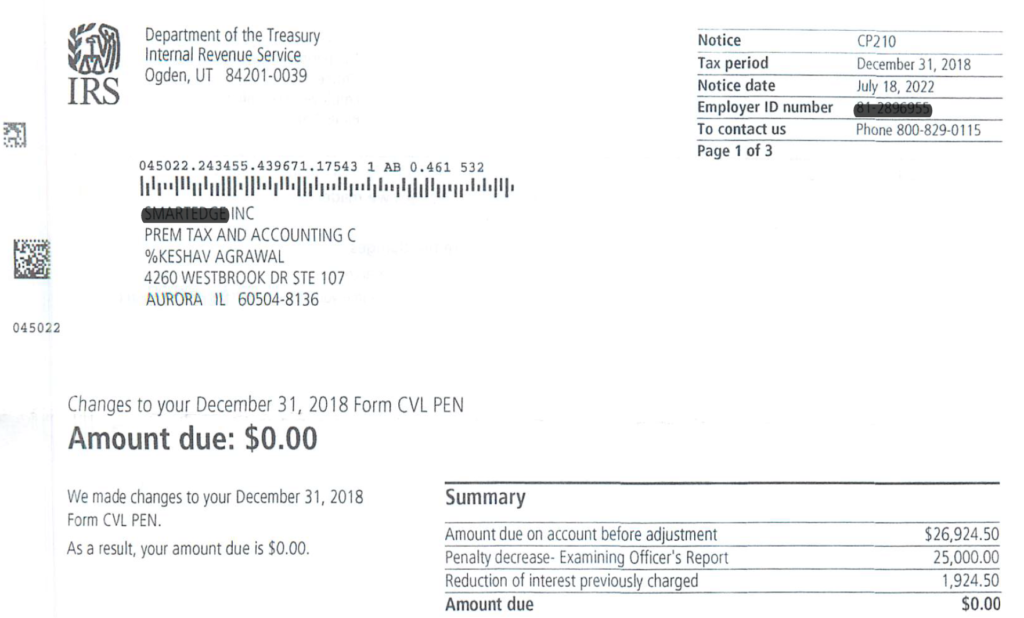

SAMPLE of our handling of IRS Issues

Income Tax - Business and Individual

Solving IRS Audit and Issues

Startups / New Business Formation

Payroll

Sales Tax and Use Tax

Income Tax - Business and Individual

Businesses:

- C Corp

- S Corp

- Partnerships

- LLCs filing as Sch C

- LLCs filing as S Corp

- LLCs filing as C Corp

- Multi-National

- Transfer Pricing

Individuals

Solving IRS Audit and Issues

- Great success rate

- Huge experience

- See samples of outcome of our IRS handling

Startups / New Business Formation

Choice of State:

Choice of entity

- C Corp

- S Corp

- LLC

Payroll

- Single or Multi-states

- County and City level compliance also

- Compliance with Labor laws

- Direct deposit included

- Employee portal

- Retirement plans

- Low cost

Sales Tax and Use Tax

- All state(s)

- Apply correct rates

- Claim all exemptions available

- Low cost

Our Locations

Prem Tax and Accounting Corp

4260 Westbrook Dr, Suite 107

Aurora, IL 60504

Aurora, IL 60504

CPA Tax Vision

1709 Ogden Ave

Lisle, IL 60532

Lisle, IL 60532

Tab #1

Tab #2

Tab #1

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Tab #2

ERC, Pandemic, Payroll, Tax Credit, Uncategorized

Employers warned to beware of third parties promoting improper Employee Retention Credit (ERC) claims

WASHINGTON — The Internal Revenue Service today warned employers to be wary of third parties who are advising them to claim the Employee Retention Credit (ERC) when they may not qualify. Some third parties are taking improper positions related to taxpayer eligibility for and computation of the credit.

These third parties often charge large upfront fees or a fee that is contingent on the amount of the refund and may not inform taxpayers that wage deductions claimed on the business’ federal income tax return must be reduced by the amount of the credit.

If the business filed an income tax return deducting qualified wages before it filed an employment tax return claiming the credit, the business should file an amended income tax return to correct any overstated wage deduction.

Businesses are encouraged to be cautious of advertised schemes and direct solicitations promising tax savings that are too good to be true. Taxpayers are always responsible for the information reported on their tax returns. Improperly claiming the ERC could result in taxpayers being required to repay the credit along with penalties and interest.

What is the ERC?

The ERC is a refundable tax credit designed for businesses who continued paying employees while shutdown due to the COVID-19 pandemic or had significant declines in gross receipts from March 13, 2020 to December 31, 2021. Eligible taxpayers can claim the ERC on an original or amended employment tax return for a period within those dates.

To be eligible for the ERC, employers must have:

- sustained a full or partial suspension of operations due to orders from an appropriate governmental authorityPDF limiting commerce, travel, or group meetings due to COVID-19 during 2020 or the first three quarters of 2021,

- experienced a significant decline in gross receipts during 2020PDF or a decline in gross receipts during the first three quarters of 2021PDF, or

- qualified as a recovery startup businessPDF for the third or fourth quarters of 2021.

As a reminder, only recovery startup businesses are eligible for the ERC in the fourth quarter of 2021. Additionally, for any quarter, eligible employers cannot claim the ERC on wages that were reported as payroll costs in obtaining PPP loan forgiveness or that were used to claim certain other tax credits.

To report tax-related illegal activities relating to ERC claims, submit Form 3949-A, Information ReferralPDF. You should also report instances of fraud and IRS-related phishing attempts to the Treasury Inspector General for Tax Administration at 800-366-4484.

Go to IRS.gov to learn more about eligibility requirements and how to claim the Employee Retention Credit :

- For qualified wages paid after March 12, 2020, and before January 1, 2021 – Notice 2021-20, Notice 2021-49, and Revenue Procedure 2021-33

- For qualified wages paid after December 31, 2020, and before July 1, 2021 – Notice 2021-23, Notice 2021-49 and Revenue Procedure 2021-33

- For qualified wages paid after June 30, 2021, and before October 1, 2021 – Notice 2021-49 and Revenue Procedure 2021-33

- For qualified wages paid after September 30, 2021, and before January 1, 2022 – Notice 2021-49 and Notice 2021-65

Uncategorized

Reminder: Service providers, others may receive 1099-Ks for sales over $600 in early 2023

IR-2022-189, October 24, 2022

WASHINGTON — The Internal Revenue Service reminds taxpayers earning income from selling goods and/or providing services that they may receive Form 1099-K, Payment Card and Third-Party Network Transactions, for payment card transactions and third-party payment network transactions of more than $600 for the year.

There is no change to the taxability of income; the only change is to the reporting rules for Form 1099-K. As before, income, including from part-time work, side jobs or the sale of goods, is still taxable. Taxpayers must report all income on their tax return unless it is excluded by law, whether they receive a Form 1099-NEC, Nonemployee Compensation; Form 1099-K; or any other information return.

The IRS emphasizes that money received through third-party payment applications from friends and relatives as personal gifts or reimbursements for personal expenses is not taxable.

The American Rescue Plan Act of 2021 (ARPA) lowered the reporting threshold for third-party networks that process payments for those doing business. Prior to 2022, Form 1099-K was issued for third party payment network transactions only if the total number of transactions exceeded 200 for the year and the aggregate amount of these transactions exceeded $20,000. Now a single transaction exceeding $600 can trigger a 1099-K.

The lower information reporting threshold and the summary of income on Form 1099-K enables taxpayers to more easily track the amounts received.

Generally, greater income reporting accuracy by taxpayers also lowers the need and likelihood of later examination.

Consider making estimated tax payments

Income taxes must generally be paid as taxpayers earn or receive income throughout the year, either through withholding or estimated tax payments.

If the amount of income tax withheld from one’s salary or pension is not enough, or if they receive other types of income, such as interest, dividends, alimony, self-employment income, capital gains, prizes and awards, they may have to make estimated tax payments.

If they are in business for themselves, individuals generally need to make estimated tax payments. Estimated tax payments are used to pay not only income tax, but other taxes as well, such as self-employment tax and alternative minimum tax.

Publication 17, Your Federal Income Tax (For Individuals), provides general rules to help taxpayers pay the income taxes they owe.

Additional helpful information is available in Chapter 5, Business Income, of Publication 334, Tax Guide for Small Business; Publication 525, Taxable and Nontaxable Income and on IRS.gov at Understanding Your Form 1099-K.

Form 1099-K, its instructions and a set of answers to frequently asked questions are available on IRS.gov.

Uncategorized

Penalties

Taxpayers who don’t meet their tax obligations may owe a penalty.

The IRS charges a penalty for various reasons, including if you don’t:

- File your tax return on time

- Pay any tax you owe on time and in the right way

- Prepare an accurate return

- Provide accurate information returns

We may charge interest on a penalty if you don’t pay it in full. We charge some penalties every month until you pay the full amount you owe.

Understand the different types of penalties, what you need to do if you get a penalty and how to avoid getting one.

How You Know You Owe a Penalty

When we charge you a penalty, we send you a notice or letter by mail. The notice or letter will tell you about the penalty, the reason for the charge and what to do next. These notices and letters include an identification number.

Verify the information in your notice or letter is correct. If you can resolve the issue in your notice or letter, a penalty may not apply.

For more information, see Understanding Your Notice or Letter.

Types of Penalties

These are some penalties we send notices and letters about:

- Information Return applies to taxpayers who don’t file or furnish their required information return or payee statement correctly by the due date.

- Failure to File applies when you don’t file your tax return by the due date.

- Failure to Pay applies when you don’t pay the tax you owe by the due date.

- Accuracy-Related applies when you don’t claim all your income or when you claim deductions or credits for which you don’t qualify.

- Erroneous Claim for Refund or Credit Penalty applies when you submit a claim for refund or credit of income tax for an excessive amount and reasonable cause does not apply.

- Failure to Deposit applies when you don’t pay employment taxes accurately or on time.

- Tax Preparer Penalties apply to tax return preparers who engage in misconduct.

- Dishonored Checks applies when your bank doesn’t honor your check or other form of payment.

- Underpayment of Estimated Tax by Corporations applies when you don’t pay estimated tax accurately or on time for a corporation.

- Underpayment of Estimated Tax by Individuals applies when you don’t pay estimated tax accurately or on time as an individual.

- International Information Reporting applies to certain taxpayers who fail to timely and correctly report foreign sourced financial activity.

Interest on a Penalty

We charge interest on penalties.

The date from which we begin to charge interest varies by the type of penalty. Interest increases the amount you owe until you pay your balance in full. For more information about the interest we charge on penalties, see Interest.

Pay a Penalty

Send us a payment or pay your taxes in full to stop future penalties and interest from adding up.

Remove or Reduce a Penalty

We may be able to remove or reduce some penalties if you acted in good faith and can show reasonable cause for why you weren’t able to meet your tax obligations. By law we cannot remove or reduce interest unless the penalty is removed or reduced.

For more information, see penalty relief.

Dispute a Penalty

If you disagree with the amount you owe, you may dispute the penalty.

Call us at the toll-free number at the top right corner of your notice or letter or write us a letter stating why we should reconsider the penalty. Sign and send your letter along with any supporting documents to the address on your notice.

Have this information when you call or send your letter:

- The notice or letter we sent you

- The penalty you want us to reconsider (for example, a 2020 late filing penalty)

- For each penalty, an explanation of why you think we should remove it

If a notice or letter we sent you has instructions or deadlines for disputing the penalty, pay careful attention. You must follow the instructions to dispute the penalty.

If you didn’t receive a notice or letter, get telephone assistance.

Avoid a Penalty

You can avoid a penalty by filing accurate returns, paying your tax by the due date, and furnishing any information returns timely. If you can’t do so, you can apply for an extension of time to file or a payment plan.

Apply for an Extension of Time to File

If you need more time to prepare your tax return, apply for an extension of time to file. This does not grant you an extension of time to pay. A payment plan can help you pay over time.

Apply for a Payment Plan

If you can’t pay the full amount of your taxes or penalty on time, pay what you can now and apply for a payment plan. You may reduce future penalties when you set up a payment plan.

Uncategorized

Plug-In Electric Drive Vehicle Credit (IRC 30D)

The Treasury Department and the IRS issued Notice 2022-46PDF requesting comments on any questions arising from the IRA amendments to the Clean Vehicle Credit. Comments should be submitted by November 4, 2022.

Updated information for consumers as of August 16, 2022

New Final Assembly Requirement

If you are interested in claiming the tax credit available under section 30D (EV credit) for purchasing a new electric vehicle after August 16, 2022 (which is the date that the Inflation Reduction Act of 2022 was enacted), a tax credit is generally available only for qualifying electric vehicles for which final assembly occurred in North America (final assembly requirement).

The Department of Energy has provided a list of Model Year 2022 and early Model Year 2023 electric vehicles that may meet the final assembly requirement. Because some models are built in multiple locations, there may be vehicles on the Department of Energy list that do not meet the final assembly requirement in all circumstances.

To identify the manufacture location for a specific vehicle, please search the vehicle identification number (VIN) of the vehicle on the VIN Decoder website for the National Highway Traffic Safety Administration (NHTSA). The website, including instructions, can be found at VIN Decoder.

Transition Rule for Vehicles Purchased before August 16, 2022

If you entered into a written binding contract to purchase a new qualifying electric vehicle before August 16, 2022, but do not take possession of the vehicle until on or after August 16, 2022 (for example, because the vehicle has not been delivered), you may claim the EV credit based on the rules that were in effect before August 16, 2022. The final assembly requirement does not apply before August 16, 2022.

Vehicles Purchased and Delivered between August 16, 2022 and December 31, 2022

If you purchase and take possession of a qualifying electric vehicle after August 16, 2022 and before January 1, 2023, aside from the final assembly requirement, the rules in effect before the enactment of the Inflation Reduction Act for the EV credit apply (including those involving the manufacturing caps on vehicles sold). If you entered into a written binding contract to purchase a new qualifying vehicle before August 16, 2022, see the rule above.

What Is a Written Binding Contract?

In general, a written contract is binding if it is enforceable under State law and does not limit damages to a specified amount (for example, by use of a liquidated damages provision or the forfeiture of a deposit). While the enforceability of a contract under State law is a facts-and-circumstances determination to be made under relevant State law, if a customer has made a significant non-refundable deposit or down payment, it is an indication of a binding contract. For tax purposes in general, a contract provision that limits damages to an amount equal to at least 5 percent of the total contract price is not treated as limiting damages to a specified amount. For example, if a customer has made a non-refundable deposit or down payment of 5 percent of the total contract price, it is an indication of a binding contract. A contract is binding even if subject to a condition, as long as the condition is not within the control of either party. A contract will continue to be binding if the parties make insubstantial changes in its terms and conditions.

Future Guidance

To reduce carbon emissions and invest in the energy security of the United States, the Inflation Reduction Act of 2022 significantly changes the eligibility rules for tax credits available for clean vehicles beginning in 2023. The Internal Revenue Service and the Department of the Treasury will post information and request comments from the public on various existing and new tax credit incentives in the coming weeks and months. Please look for updates on IRS.gov and other announcements from the Administration

Pre-Inflation Reduction Act of 2022 Information

The information below pre-dates the enactment of the Inflation Reduction Act of 2022 but, subject to the final assembly rule described above, remains relevant for qualifying vehicles purchased and delivered prior to January 1, 2023.

Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks.

For vehicles acquired after December 31, 2009, the credit is equal to $2,500 plus, for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity, $417, plus an additional $417 for each kilowatt hour of battery capacity in excess of 5 kilowatt hours. The total amount of the credit allowed for a vehicle is limited to $7,500.

The credit begins to phase out for a manufacturer’s vehicles when at least 200,000 qualifying vehicles have been sold for use in the United States (determined on a cumulative basis for sales after December 31, 2009). For additional information see Notice 2009-89.

Section 30D originally was enacted in the Energy Improvement and Extension Act of 2008. The American Recovery and Reinvestment Act of 2009 amended section 30D effective for vehicles acquired after December 31, 2009. Section 30D was also modified by the American Taxpayer Relief Act (ATRA) 2013 for certain 2 or 3 wheeled vehicles acquired after December 31, 2011 and before January 1, 2014.

The vehicles must be acquired for use or lease and not for resale. Additionally, the original use of the vehicle must commence with the taxpayer and the vehicle must be used predominantly in the United States. For purposes of the 30D credit, a vehicle is not considered acquired prior to the time when title to the vehicle passes to the taxpayer under state law.

Notice 2009-89 applies to vehicles acquired subsequent to December 31, 2009 and provides procedures that a vehicle manufacturer may use if it chooses to certify that a vehicle meets certain requirements that must be satisfied to claim the Qualified Plug-in Electric Drive Motor Vehicle Credit and the amount of the credit allowable with respect to that vehicle

Credit Amounts for Qualified Vehicles Acquired After December 31, 2009

Qualified Plug-In Electric Drive Motor Vehicle Credit (IRC 30D) Phase Out

The qualified plug-in electric drive motor vehicle credit phases out for a manufacturer’s vehicles over the one-year period beginning with the second calendar quarter after the calendar quarter in which at least 200,000 qualifying vehicles manufactured by that manufacturer have been sold for use in the United States (determined on a cumulative basis for sales after December 31, 2009) (“phase-out period”). Qualifying vehicles manufactured by that manufacturer are eligible for 50 percent of the credit if acquired in the first two quarters of the phase-out period and 25 percent of the credit if acquired in the third or fourth quarter of the phase-out period. Vehicles manufactured by that manufacturer are not eligible for a credit if acquired after the phase-out period.

Uncategorized

Reschedule payments set for April 15 to July 15

REMINDER: Schedule and pay federal taxes electronically due by July 15; only a few hours remaining for taxpayers to reschedule payments set for April 15

The Internal Revenue Service reminds taxpayers they have several options to schedule and pay federal taxes electronically that are due on July 15. Taxpayers with payments scheduled for April 15 also have a midnight Monday deadline to reschedule payments.

Several options allow taxpayers to schedule payments up to a year in advance. For taxpayers using Direct Pay and Electronic Funds Withdrawal (EFW) with payments scheduled for April 15, they will need to take special steps to reschedule their payments if they would like a later date. Direct Pay and EFW users with a scheduled April 15 deadline will need to reschedule these payments before midnight Eastern time on Monday.

In Notice 2020-18 (PDF), the Treasury Department and the Internal Revenue Service announced special Federal income tax return filing and payment relief in response to the ongoing Coronavirus Disease 2019 (COVID-19) emergency.

The Federal income tax filing due date is automatically extended from April 15 to July 15. Taxpayers can also defer federal income tax payments due on April 15 to July 15 without penalties and interest, regardless of the amount owed. This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax. Taxpayers do not need to file any additional forms or call the IRS to qualify for this automatic federal tax filing and payment relief.

Best Indian CPA (Certified Public Accountant) in Aurora, IL

February 5, 2023

No Comments

Keshav Prem Agrawal, CPA, CAQualifications include: M Com (Master’s degree in Commerce) CA (Chartered Accountant) CPA (Certified Public Accountant) CWA (Cost and Works Accountant) CIA (Certified Internal Auditor) CISA (Certified Information System Auditor)Click Here for more info on Keshav Agrawal, CPA , CAKeshav Prem Agrawal, CPA, CAHuge Experience: 15+ Years as CPA in USA Currently

Top 10 Questions You May Ask this Tax Season

November 12, 2022

No Comments

Answer to top 10 tax questions answered by an experienced CPA, tax preparer, and tax expert offer free initial consulting. Q1: What do I need to do to prepare for tax year 2022 season? Please start gathering the following forms, documents, and information. These are generic and depending on your tax situation, you may need

Marriage Penalty

November 11, 2022

No Comments

What Is a Marriage Penalty? A marriage penalty is when a household’s overall tax bill is higher if the married couple file taxes jointly. A marriage penalty typically occurs when both spouses have similar incomes. This is true for both high- and low-income couples. Federal Marriage Penalty Prior to the Tax Cuts and Jobs Act (TCJA) of

Employee Retention Credit (ERC)- 2020 vs 2021 Comparison Chart

November 10, 2022

No Comments

The federal government established the Employee Retention Credit (ERC) to provide a refundable employment tax credit to help businesses with the cost of keeping staff employed. Eligible businesses that experienced a decline in gross receipts or were closed due to government order and didn’t claim the credit when they filed their original return can take

Employers warned to beware of third parties promoting improper Employee Retention Credit (ERC) claims

November 10, 2022

No Comments

WASHINGTON — The Internal Revenue Service today warned employers to be wary of third parties who are advising them to claim the Employee Retention Credit (ERC) when they may not qualify. Some third parties are taking improper positions related to taxpayer eligibility for and computation of the credit. These third parties often charge large upfront

Reminder: Service providers, others may receive 1099-Ks for sales over $600 in early 2023

November 7, 2022

No Comments

IR-2022-189, October 24, 2022 WASHINGTON — The Internal Revenue Service reminds taxpayers earning income from selling goods and/or providing services that they may receive Form 1099-K, Payment Card and Third-Party Network Transactions, for payment card transactions and third-party payment network transactions of more than $600 for the year. There is no change to the taxability

Penalties

November 7, 2022

No Comments

Taxpayers who don’t meet their tax obligations may owe a penalty. The IRS charges a penalty for various reasons, including if you don’t: File your tax return on time Pay any tax you owe on time and in the right way Prepare an accurate return Provide accurate information returns We may charge interest on a

Plug-In Electric Drive Vehicle Credit (IRC 30D)

November 7, 2022

No Comments

The Treasury Department and the IRS issued Notice 2022-46PDF requesting comments on any questions arising from the IRA amendments to the Clean Vehicle Credit. Comments should be submitted by November 4, 2022. Updated information for consumers as of August 16, 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section

Reschedule payments set for April 15 to July 15

April 13, 2020

No Comments

REMINDER: Schedule and pay federal taxes electronically due by July 15; only a few hours remaining for taxpayers to reschedule payments set for April 15 The Internal Revenue Service reminds taxpayers they have several options to schedule and pay federal taxes electronically that are due on July 15. Taxpayers with payments scheduled for April 15

Don’t be victim to a ‘ghost’ tax return preparer

March 13, 2019

No Comments

Today, towards the end of the second full week of the 2019 tax filing season, the Internal Revenue Service warned taxpayers to avoid unethical tax return preparers, known as ghost preparers. By law, anyone who is paid to prepare or assist in preparing federal tax returns must have a valid 2019 Preparer Tax Identification Number,

Individuals who need passports for imminent travel should contact IRS promptly to resolve tax debt

March 13, 2019

No Comments

The Internal Revenue Service today reiterated its warning that taxpayers may not be able to renew a current passport or obtain a new passport if they owe federal taxes. To avoid delays in travel plans, taxpayers need to take prompt action to resolve their tax issues. In January of last year, the IRS began implementing

Cash payment report helps government combat money laundering

March 13, 2019

No Comments

Federal law requires a person to report cash transactions of more than $10,000 by filing IRS Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. The information on the form helps law enforcement combat money laundering, tax evasion, drug dealing, terrorist financing and other criminal activities. Who is covered By law,

Uncategorized

Don’t be victim to a ‘ghost’ tax return preparer

Today, towards the end of the second full week of the 2019 tax filing season, the Internal Revenue Service warned taxpayers to avoid unethical tax return preparers, known as ghost preparers.

By law, anyone who is paid to prepare or assist in preparing federal tax returns must have a valid 2019 Preparer Tax Identification Number, or PTIN. Paid preparers must sign the return and include their PTIN.

But ‘ghost’ preparers do not sign the return. Instead, they print the return and tell the taxpayer to sign and mail it to the IRS. Or, for e-filed returns, they prepare but refuse to digitally sign it as the paid preparer.

According to the IRS, similar to other tax preparation schemes, dishonest and unscrupulous ghost tax return preparers look to make a fast buck by promising a big refund or charging fees based on a percentage of the refund. These scammers hurt honest taxpayers who are simply trying to do the right thing and file a legitimate tax return.

Ghost tax return preparers may also:

- Require payment in cash only and not provide a receipt.

- Invent income to erroneously qualify their clients for tax credits or claim fake deductions to boost their refunds.

- Direct refunds into their own bank account rather than the taxpayer’s account.

The IRS urges taxpayers to review their tax return carefully before signing and ask questions if something is not clear. And for any direct deposit refund, taxpayers should make sure both the routing and bank account number on the completed tax return are correct.

The IRS offers tips to help taxpayers choose a tax return preparer wisely. The Choosing a Tax Professional page has information about tax preparer credentials and qualifications. The IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications can help identify many preparers by type of credential or qualification.

Taxpayers can report abusive tax preparers to the IRS. Use Form 14157, Complaint: Tax Return Preparer. If a taxpayer suspects a tax preparer filed or changed their tax return without their consent, they should file Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit.

Uncategorized

Individuals who need passports for imminent travel should contact IRS promptly to resolve tax debt

The Internal Revenue Service today reiterated its warning that taxpayers may not be able to renew a current passport or obtain a new passport if they owe federal taxes. To avoid delays in travel plans, taxpayers need to take prompt action to resolve their tax issues.

In January of last year, the IRS began implementing new procedures affecting individuals with “seriously delinquent tax debts.” These new procedures implement provisions of the Fixing America’s Surface Transportation (FAST) Act. The law requires the IRS to notify the State Department of taxpayers the IRS has certified as owing a seriously delinquent tax debt, which is $52,000 or more. The law also requires State to deny their passport application or renewal. If a taxpayer currently has a valid passport, the State Department may revoke the passport or limit ability to travel outside the United States.

When the IRS certifies a taxpayer to the State Department as owing a seriously delinquent tax debt, they receive a Notice CP508C from the IRS. The notice explains what steps a taxpayer needs to take to resolve the debt. Please note, the IRS doesn’t send copies of the notice to powers of attorney. IRS telephone assistors can help taxpayers resolve the debt, for example, they can help taxpayers set up a payment plan or make them aware of other payment alternatives. Taxpayers shouldn’t delay because some resolutions take longer than others, such as adjusting a prior tax assessment.

When a taxpayer no longer has a seriously delinquent tax debt, because they paid it in full or made another payment arrangement, the IRS will reverse the taxpayer’s certification within thirty days. State will then remove the certification from the taxpayer’s record, so their passport won’t be at risk under this program. The IRS can expedite the decertification notice to the State Department for a taxpayer who resolves their debt, has a pending passport application and has imminent travel plans or lives abroad with an urgent need for a passport.

A taxpayer with a seriously delinquent tax debt is generally someone who owes the IRS more than $52,000 in back taxes, penalties and interest for which the IRS has filed a Notice of Federal Tax Lien and the period to challenge it has expired or the IRS has issued a levy.

Before denying a passport renewal or new passport application, the State Department will hold the taxpayer’s application for 90 days to allow them to:

- Resolve any erroneous certification issues,

- Make full payment of the tax debt, or

- Enter a satisfactory payment arrangement with the IRS.

Ways to Resolve Tax Issues

There are several ways taxpayers can avoid having the IRS notify the State Department of their seriously delinquent tax debt. They include the following:

- Paying the tax debt in full,

- Paying the tax debt timely under an approved installment agreement,

- Paying the tax debt timely under an accepted offer in compromise,

- Paying the tax debt timely under the terms of a settlement agreement with the Department of Justice,

- Having requested or have a pending collection due process appeal with a levy, or

- Having collection suspended because a taxpayer has made an innocent spouse election or requested innocent spouse relief.

Uncategorized

Cash payment report helps government combat money laundering

Federal law requires a person to report cash transactions of more than $10,000 by filing IRS Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. The information on the form helps law enforcement combat money laundering, tax evasion, drug dealing, terrorist financing and other criminal activities.

Who is covered

By law, a “person” is an individual, company, corporation, partnership, association, trust or estate. For example, dealers in jewelry, furniture, boats, aircraft or automobiles; pawnbrokers; attorneys; real estate brokers; insurance companies and travel agencies are among those who typically need to file Form 8300.

Tax-exempt organizations are also “persons” and may need to report certain transactions. A tax-exempt organization doesn’t have to file Form 8300 for a charitable cash contribution. Note, however, that under a separate requirement, a donor often must obtain a written acknowledgement of the contribution from the organization. See Publication 526, Charitable Contributions, for details. But the organization must report noncharitable cash payments on Form 8300. For example, an exempt organization that receives more than $10,000 in cash for renting part of its building must report the transaction.

What’s cash

For Form 8300 reporting, cash includes coins and currency of the United States or any foreign country. It’s also a cashier’s check (sometimes called a treasurer’s check or bank check), bank draft, traveler’s check or money order with a face amount of $10,000 or less that a person receives for:

- A designated reporting transaction or

- Any transaction in which the person knows the payer is trying to avoid a report.

Note that under a separate reporting requirement, banks and other financial institutions report cash purchases of cashier’s checks, treasurer’s checks and/or bank checks, bank drafts, traveler’s checks and money orders with a face value of more than $10,000 by filing currency transaction reports.

A designated reporting transaction is the retail sale of tangible personal property that’s generally suited for personal use, expected to last at least one year and has a sales price of more than $10,000. Examples are sales of automobiles, jewelry, mobile homes and furniture.

A designated reporting transaction is also the sale of a collectible, such as a work of art, rug, antique, metal, stamp or coin. It is also the sale of travel and entertainment, if the total price of all items for the same trip or entertainment event is more than $10,000.

Reporting cash payments

A person must file Form 8300 if they receive cash of more than $10,000 from the same payer or agent:

- In one lump sum.

- In two or more related payments within 24 hours. For example, a 24-hour period is 11 a.m. Tuesday to 11 a.m. Wednesday.

- As part of a single transaction or two or more related transactions within 12 months.

Examples of reporting situations

Automobile dealerships

- If a husband and wife purchased two cars at one time from the same dealer, and the dealer received a total of $10,200 in cash, the dealer can view the transaction as a single transaction or two related transactions. Either way, it calls for only one Form 8300.

- A dealership doesn’t file Form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. A wire transfer is not cash.

- A customer purchases a car for $9,000 cash. Within 12 months, the customer pays the dealership cash of $1,500 for accessories for that car. The dealer doesn’t need to file Form 8300, unless they knew or had reason to know the transactions were connected.

Taxi company

Weekly lease payments in cash from a taxi driver to a taxi company within 12 months is considered the same transaction. The taxi company needs to file Form 8300 when the total amount exceeds $10,000. Then, if the company receives more than $10,000 cash in additional payments from the driver within 12 months, the company must file another Form 8300.

Landlords

Landlords need to file Form 8300 once they’ve received more than $10,000 in cash for a lease during the year. But a person not in the trade or business of managing or leasing real property, such as someone who leases their vacation home for part of the year, doesn’t need to report a cash receipt of more than $10,000.

Bail-bonding agent

A bail-bonding agent must file Form 8300 when they receive more than $10,000 in cash from a person. This applies to payments from persons who have been arrested or anticipate arrest. The agent needs to file the form even though they haven’t provided a service when they received the cash.

Colleges and universities

Colleges and universities must file Form 8300, if they receive more than $10,000 in cash in one or more transactions within 12 months.

Home builders

Home builders and contractors need to file Form 8300 if they receive cash of more than $10,000 for building, renovating or remodeling.

When to file Form 8300

A business must file Form 8300 within 15 days after the date the business received the cash. If a business receives later payments toward a single transaction or two or more related transactions, the business should file Form 8300 when the total amount paid exceeds $10,000.

Each time payments aggregate more than $10,000, the business must file another Form 8300.

How to file

A person can file Form 8300 electronically using the Financial Crimes Enforcement Network’s BSA E-Filing System. E-filing is free, quick and secure. Filers will receive an electronic acknowledgement of each submission.

Those who prefer to mail Form 8300 can send it to Internal Revenue Service, Federal Building, P.O. Box 32621, Detroit, MI 48232. Filers can confirm the IRS received the form by sending it via certified mail with return receipt requested or calling the Detroit Federal Building at 866-270-0733.

Taxpayer identification number

Form 8300 requires the taxpayer identification number (TIN) of the person paying with cash. If they refuse to provide it, the business should inform the person that the IRS may assess a penalty.

If the business is unable to obtain the customer’s TIN, the business should file Form 8300 anyway. The business needs to include a statement with Form 8300 that explains why the form doesn’t have a TIN. The business should keep records showing it requested the customer’s TIN and give the records to the IRS upon request.

Informing customers about Form 8300 filing

The business must give a customer written notice by Jan. 31 of the year following the transaction that it filed Form 8300 to report the customer’s cash transaction.

- The government doesn’t offer a specific format for the customer statement, but it must:

- Be a single statement aggregating the value of the prior year’s transactions,

- Have the name, address and phone number of the person who needs to file the Form 8300 and

- Inform the customer the business is reporting the payment to the IRS.

A business can give a customer who only had one transaction during the year a copy of the invoice or Form 8300 as notification if it has the required information. The government doesn’t recommend using a copy of Form 8300 because of sensitive information on the form, such as the employer identification number or Social Security number of the person filing the Form 8300.

A business may voluntarily file Form 8300 to report a suspicious transaction below $10,000. In this situation, the business doesn’t let the customer know about the report. The law prohibits a business from informing a customer that it marked the suspicious transaction box on the form.